Post-Holiday eCommerce Reset: Clean Up Q4 Debt This January

Written by

Cassandra Gaston

Published on

Jan 13, 2026

Q4 is behind you. Traffic dropped back to normal levels, the last-minute order crush ended, and your team can breathe again. But here's the problem most eCommerce operations teams ignore: all that commerce debt you accumulated during the holiday sprint doesn't just disappear.

The workarounds you deployed to keep your site running, the promotional rules you stacked on top of existing logic, the inventory adjustments you made manually when your system couldn't keep up with demand: these created operational debt that's going to slow you down in 2026 unless you deal with it now.

You have January to clean this up. After that, it gets a lot harder.

Why January Is Actually Your Most Important Operations Month

Most eCommerce operations teams treat the post-holiday period like recovery time. Traffic's down, revenue pressure eases, everyone's burned out from Q4. It's tempting to coast. That's expensive.

Your operational mess doesn't improve with age. Those promotional rules that should have expired on December 31st? Still running. Inventory counts are wrong because you were manually adjusting quantities during peak. Customer data is a disaster of duplicates and bad addresses. Your product catalog is inconsistent because you were pushing SKUs live without proper taxonomy.

This debt compounds. Each day you wait, your site gets slower, your data gets messier, your team spends more time working around problems instead of building new features.

The eCommerce operations teams launching new capabilities in Q2 are the ones who spent January cleaning up. Everyone else is still cleaning up last year's workarounds.

Q4 promotions are designed for urgency. Launching them fast because the calendar didn't allow choice: free shipping thresholds, BOGO deals, flash discounts stacked with loyalty points, time-sensitive codes, gift bundles, tiered bulk discounts. Now they're haunting systems.

Promotional rule complexity spikes 40-50% during Q4, with many of those rules lingering into January because cleanup wasn't prioritized. Every expired promotion the system is still checking against slows down cart calculations and checkout processing.

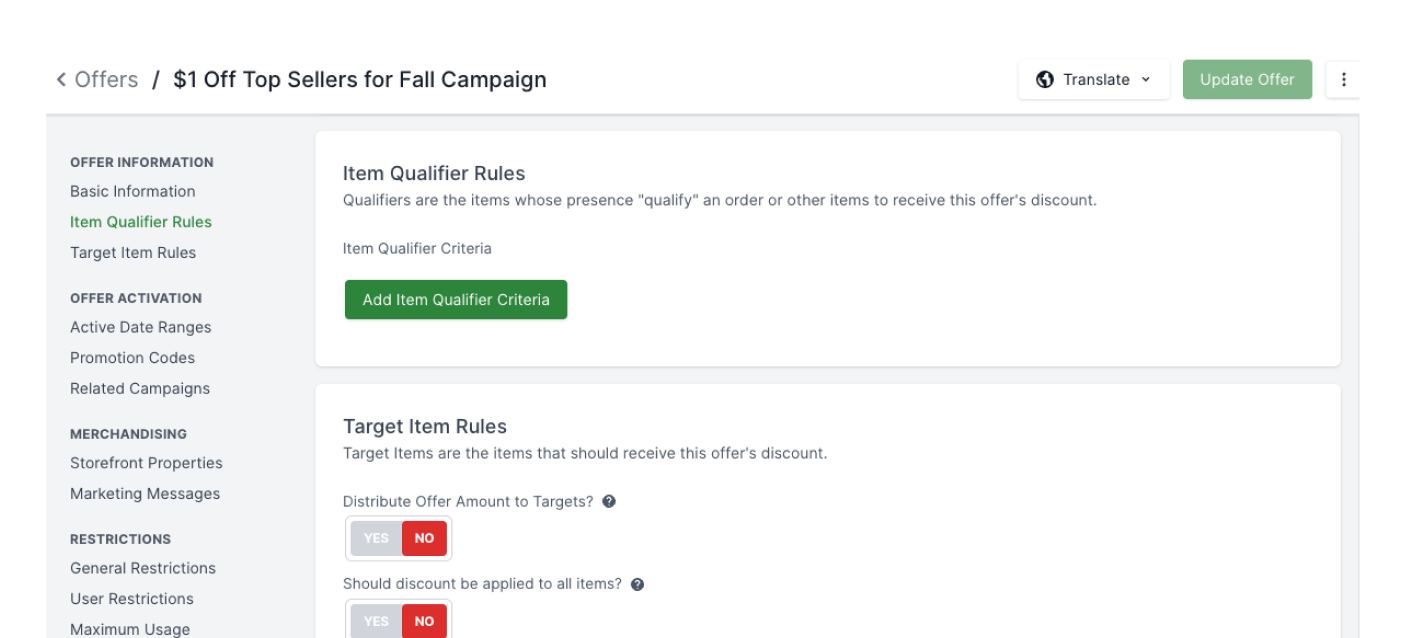

Pull every promotional rule that was active between October and December. Figure out which ones are still running when they shouldn't be, and disable them. Then go deeper and look for rules that are technically expired but never got archived, which means they're still sitting in the database bloating queries.

Pay special attention to stacked promotions. If campaigns ran where multiple discounts could apply simultaneously, the promotion engine is doing extra calculations on every cart to check eligibility.

The goal is getting back to a lean promotional foundation so when Valentine's Day or spring campaigns launch, the system responds quickly instead of choking on legacy logic.

The Inventory Numbers Are Lying to You

Holiday returns hit 18% of merchandise, and most of that volume lands in your system between December 26 and mid-January. Orders show as complete while the items are coming back. Your inventory counts say those units are sold, but they're about to reappear.

When your inventory data is wrong, your merchandising decisions follow. You might order more of a "sold out" SKU when you've got 5,000 units sitting in returns. Or you're showing items as available online when all you have left are damaged returns.

Reconcile this in January. Match order history against actual inventory. Process returns fast and update quantities in real-time. Write off damaged goods. If you're running multiple fulfillment locations, audit each one separately because this is where the discrepancies hide.

For omnichannel operations, it gets messier. Store inventory, warehouse inventory, and in-transit inventory all need reconciliation. Items show as available online because they're technically in a store location, but that store hasn't updated counts since early December.

Clean your inventory data before you start planning spring merchandising. Otherwise you're making buy decisions based on fiction.

The Customer Data Chaos Nobody Wants to Talk About

Holiday shopping creates terrible customer data. People rush through checkout using work emails because they're shopping during breaks. Addresses get mistyped. Multiple accounts get created when someone forgets their login.

By January, your customer database is a mess of duplicates, incomplete records, and bad data. If you don't clean it up, your personalization and segmentation won't work.

This matters for post-holiday retention. First-time holiday shoppers are valuable targets for turning into repeat customers, but only if you can identify them and send relevant messaging. If your data's a mess, you're either not reaching them or sending duplicate emails because they exist in your system three times with slightly different addresses.

Deduplication comes first: merge obvious duplicates, flag ones that need manual review, update incomplete profiles.

Then segment. Tag everyone who made their first purchase during Q4. They need different messaging than your repeat customers. Separate gift recipients from gift purchasers because they have different relationships with your brand.

Clean data makes everything else work better in 2026. Skip this and your personalization stays generic, your segments stay inaccurate, your retention campaigns underperform.

Sites got slower during Q4 as page load times crept up, checkout took longer, and search results lagged. But stopping to fix it wasn't an option in survival mode while trying to process orders.

That performance debt is still sitting on infrastructure. Images uploaded without optimization are still there. Scripts added for holiday tracking were never removed. Database queries got slower as tables grew.

Site speed directly impacts conversion. 1-second sites convert 3x better than 5-second sites. Each extra second drops conversion by 4.42%. If sites are slower now than they were in September, money is being lost on every visitor.

Run a performance audit by checking page load times across key pages (homepage, category pages, product pages, cart, and checkout), identifying what's slow and why, removing unused scripts and trackers, optimizing images that were rushed live during holiday campaigns, and cleaning up the database by archiving old order data.

This is also when to address any quick fixes or patches implemented during Q4. That workaround built to handle a specific holiday scenario? Either properly engineer it or remove it. Temporary solutions that stick around become permanent problems.

Fulfillment Workflows That Broke Under Pressure

Q4 exposed every weakness in fulfillment operations. Maybe routing logic couldn't handle the volume and started sending orders to the wrong warehouses. Maybe returns processing backed up because there wasn't capacity to inspect and restock items fast enough.

Returns cost 20-65% of item value to process. If returned items sit in a queue for weeks before being inspected and restocked, sales are being lost on inventory that's technically owned but can't be sold.

January is the time to fix these workflows. Review order routing rules. If certain fulfillment locations consistently underperformed, adjust the logic. Look at returns processing time from receipt to restock and identify bottlenecks. If damaged goods are sitting in limbo because nobody has clear authority to write them off, establish those rules now.

For omnichannel operations, audit how well stores handled online order fulfillment. If stores were frequently marking items as out of stock after orders were placed, inventory visibility between channels is broken.

Document what broke and why so this becomes the playbook for next Q4.

Catalog Consistency That Fell Apart

During Q4, products were launched fast (new holiday SKUs, gift sets, limited editions, seasonal variations) and speed mattered more than perfection, so data quality slipped.

Now catalogs are inconsistent. Some products have detailed attributes, others are missing basic information. Color names aren't standardized (one item is "navy" while another is "dark blue"). Size charts vary by product line. Categories are applied inconsistently.

This creates real problems. Site search doesn't work well because it can't match customer queries to inconsistent product data. Filtering and faceting are broken because attributes aren't standardized. Recommendations engines can't bundle products intelligently.

Standardize the catalog now by defining clear taxonomies for colors, sizes, materials, and categories, then applying them consistently while filling in missing attributes and writing unique product descriptions instead of using duplicated content.

This work is tedious, but it pays off every day for the rest of the year. Clean product data improves search relevance, sharpens recommendations, enables smarter merchandising, and makes the overall experience smoother for customers.

Why This Can't Wait Until February

The longer the wait to address Q4 debt, the more expensive it becomes to fix. Promotional rules that are still active will conflict with the next campaign. Bad inventory data will lead to incorrect buy decisions. Messy customer data will hobble Q1 retention campaigns. Performance issues will cost conversions on every visit.

Plus, team memory of what happened and why is fading. The person who built that workaround during Black Friday is starting to forget the context. Fix things now while the details are still fresh.

February is when you should be planning and executing your spring strategy, not cleaning up holiday messes. The brands that treat January as operational cleanup month are the ones that execute smoothly the rest of the year.

Getting This Done Without Burning Out Your Team

Teams are exhausted and nobody wants to spend January doing tedious data cleanup and system maintenance. But skipping this work creates a worse problem later when trying to launch new features while fighting with legacy issues instead.

Prioritize ruthlessly because not everything needs fixing. Focus on the issues that will cause the most pain if left unaddressed. Expired promotional rules that are still active? Critical. Duplicate customer records? Important. That edge case in the search algorithm that only affects 1 product? Probably not urgent.

Break the work into concrete projects with clear scope. "Clean up promotions" is overwhelming. "Audit and disable all promotional rules active between October and December" is manageable.

The brands getting through January cleanup fastest have platforms designed for operational flexibility. Their promotional engines are rule-based and business-user-friendly, which means marketing can disable expired campaigns without filing engineering tickets. Real-time, centralized inventory management means reconciliation happens automatically rather than through manual audits.

Broadleaf Commerce was built for this kind of operational complexity. Teams can set expiration dates and automatic archiving in the promotional framework, which prevents rules from lingering and creating technical debt. The inventory system gives real-time visibility across all fulfillment locations with reconciliation tools built in. For customer data, deduplication and segmentation work straightforwardly rather than requiring custom scripts and manual review.

If January cleanup feels like an endless slog of manual work and custom fixes, it's a signal the platform wasn't designed for operational agility. Modern commerce platforms handle this kind of maintenance as routine rather than crisis.

Post-Holiday Cleanup FAQ

Why is January critical for eCommerce operations? Your team still remembers what happened during Q4: which promotions broke, where inventory got messy, what workarounds you deployed. That memory fades fast. By February, people forget the context and you're guessing at what needs fixing. Plus, you've got breathing room before Valentine's Day campaigns need to launch. January is the only month where you can focus on cleanup without competing priorities.

What should I prioritize first in my post-holiday reset? Promotional rules are the biggest immediate risk because they can conflict with your next campaign and they're actively slowing down your site right now. Get those cleaned up first. Inventory reconciliation matters too since returns are coming in daily, so run that in parallel. Customer data and performance optimization can wait a week or two since they're important but not urgent unless something's actively broken.

How long does Q4 cleanup typically take? If you start in early January with dedicated time, figure on three to four weeks for a thorough cleanup. Promotional audits and basic inventory reconciliation happen in the first week. Returns processing and customer data work take another week or two. Catalog standardization and platform updates fill week three. The fourth week is for segmentation work and making sure everything actually got fixed. Wait until mid-January and you're looking at six to eight weeks because problems have multiplied and your team's memory has faded.

Can I automate any of this post-holiday maintenance? Good commerce platforms handle a lot of this automatically. Promotional rules should expire on their own if you set them up right. Inventory reconciliation should happen in real-time instead of requiring manual spreadsheet work. Customer data deduplication should be built into your CRM rather than needing custom scripts. If you're spending January doing tons of manual cleanup, your platform probably isn't built for operational flexibility.

Your January Checklist

Week 1: Audit all Q4 promotional rules and disable anything still active. Start inventory reconciliation across all fulfillment locations. Run performance audit on key site pages.

Week 2: Process and restock holiday returns. Begin customer data deduplication and cleanup. Remove or properly integrate temporary holiday solutions.

Week 3: Standardize product catalog data (colors, sizes, attributes, categories). Apply platform updates and security patches. Document fulfillment workflow issues discovered during Q4.

Week 4: Complete customer segmentation for Q1 campaigns. Archive old promotional rules and obsolete inventory. Test site performance to confirm improvements.

Nobody celebrates promotional rule cleanup or color name standardization, but this operational foundation determines whether 2026 runs smoothly or turns into twelve months of fighting technical debt inherited from Q4. Most eCommerce operations teams will put this off because they're burned out, which creates an opening for the ones who treat January as reset month with a clear post-holiday strategy rather than just recovery time.