Stop Treating Your Stores and Warehouses Like Separate Systems

Written by

Cassandra Gaston

Published on

Feb 17, 2026

Most retailers run their stores and warehouses as two completely different businesses. Online orders pull from the warehouse. Store inventory serves walk-in customers. The two never talk to each other.

That disconnect costs real money. The warehouse runs out of a popular item while three store locations have it sitting on shelves. Customers who live minutes from a stocked store wait days for a warehouse shipment from across the country. Slow sellers pile up at one location and get marked down when they could have filled online orders from another.

Retailers who figure out how to use their entire inventory network as one system gain clear advantages: lower shipping costs, faster delivery, fewer markdowns, and more ways for customers to buy. But getting there requires your commerce platform to actually know where inventory sits and route orders accordingly.

The Real Cost of Disconnected Inventory

When your online channel can only see warehouse inventory, you're leaving money on the table in ways you might not even be tracking.

Start with shipping. Last-mile delivery now accounts for 53% of total shipping costs, up from 41% in 2018. Every online order that ships from a centralized warehouse instead of a nearby store adds unnecessary distance to that last mile. For context, one analysis found that shipping a package Zone 2 from a local store costs 35% less than shipping Zone 5 from a centralized fulfillment center — $14.28 versus $21.84. When your platform can't route to the closest location, you're eating that margin on every order.

Delivery speed takes a hit too, but for a less obvious reason. It's not just about carrier speed; it's about distance. An order fulfilled from a store nearby arrives faster via ground shipping than a warehouse shipment from several states away, even with an expedited label on it.

Then there's inventory that just sits there. Products that aren't selling at a particular store can't flow to online orders where there's demand. They sit until they're marked down or written off. Multiply that across dozens of locations, and the waste gets expensive fast.

And you're shutting yourself out of fulfillment options that customers now treat as a given. U.S. click-and-collect sales are projected to surpass $154 billion in 2025, and over 150 million Americans now actively use BOPIS. More importantly for your P&L, 70% of BOPIS shoppers buy additional items once they're in the store. If you can't offer pickup because your commerce platform doesn't track store-level inventory, you're handing those sales and that foot traffic to competitors who can.

Meanwhile, 48% of shoppers abandon carts over shipping costs. Location-specific availability doesn't just reduce abandonment through confidence ("available for pickup at your nearest store"); it can eliminate the shipping cost problem entirely.

What Unified Inventory Actually Looks Like

Connecting your inventory network doesn't mean dumping everything into one pool. It means your platform understands each location's inventory independently and uses that to route fulfillment well.

Each physical location has its own inventory counts and its own capabilities. A distribution center might handle high-volume shipping but not pickups. A retail store might do both. A small-format location might only serve walk-in traffic. The point is that each one gets configured based on what it can actually do, and the platform factors all of them into fulfillment decisions.

Say a customer near one of your stores places an order. The system knows that the store has the item in stock and can route the order there instead of defaulting to a warehouse several states away.

What the Customer Sees

The biggest change is on your product pages. Instead of a generic "in stock" message, customers see location-specific availability — "available for pickup at your nearest store" or "12 in stock nearby." That specificity converts better because it answers the question shoppers are actually asking: can I get this thing quickly, near me?

From there, customers can mix fulfillment methods within a single order. Pick up two items at one store, have a third shipped. At checkout, everything is grouped by location, so there's no confusion about where each item is coming from.

Operationally, this simplifies things rather than complicating them. Each store only sees the orders assigned to it. Warehouse staff see only their shipments. The routing happens automatically based on customer choices and your fulfillment rules — nobody is manually triaging orders across locations.

Ship-from-Store and Multi-Warehouse Routing

Once your inventory network is connected, fulfillment strategies that used to require heavy custom work become straightforward.

Target is probably the best-known example of this in practice. As of late 2023, over 80% of Target's online orders are fulfilled from store inventory, and the company credits the strategy with cutting fulfillment costs by roughly 40%. You don't need to be Target-sized to benefit from the same principle: routing orders to the nearest location with inventory reduces distance, cost, and delivery time.

Multiple warehouses? Orders can route to the one nearest the customer. The system checks which warehouse has inventory, figures out which is closest, and assigns the order.

Ship-from-store works the same way, but with your retail locations filling online orders from their floor inventory. A customer places an online order, the system identifies which stores have the item, and the nearest one picks, packs, and ships it. Inventory that once served only foot traffic now supports online demand, and your warehouses shouldn't shoulder the entire fulfillment burden every time there's a volume spike.

Making It Work Without a Major Integration Project

Multi-location inventory used to require either expensive custom development or bolting on third-party systems that needed constant maintenance. That's what kept most enterprise retailers from implementing these strategies even when the payoff was obvious.

If you're running an existing ERP or legacy order management system, the idea of connecting store-level inventory to your commerce platform probably sounds like a painful integration project. That's been the reality for years — and it's the main reason so many retailers still have their online and in-store inventory operating in silos.

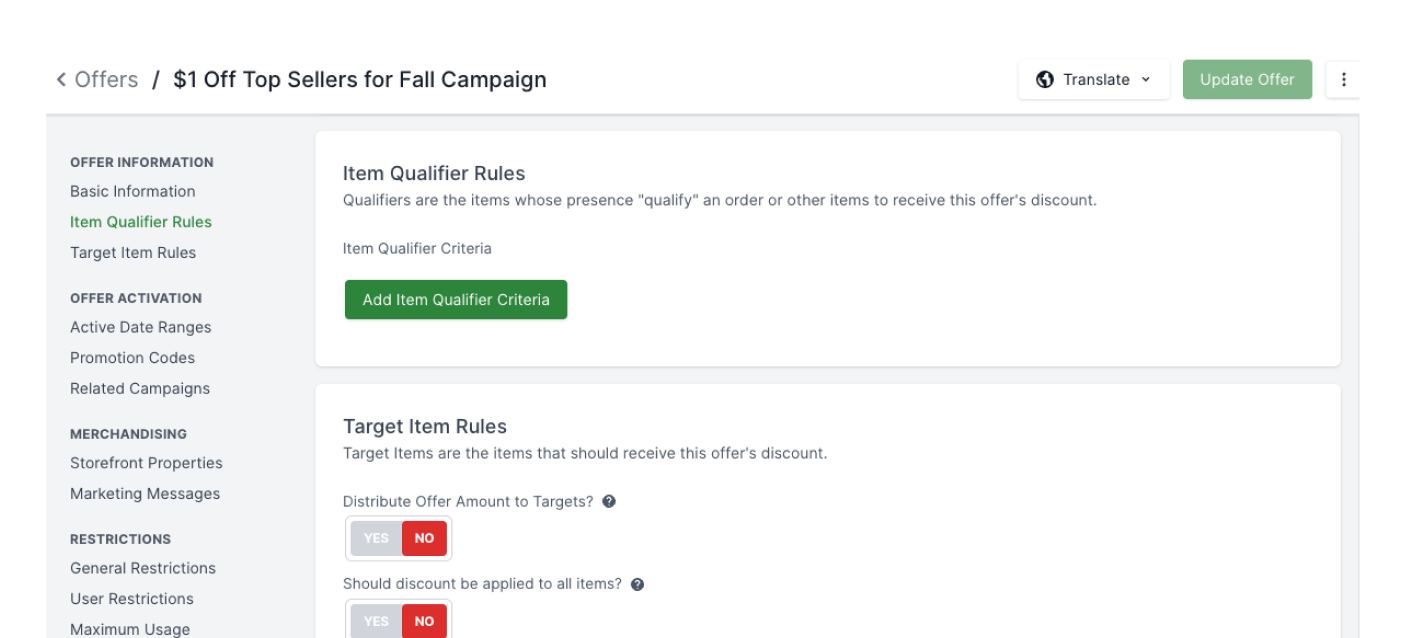

Broadleaf handles this natively. Location-based inventory tracking, fulfillment routing, and BOPIS support are built into the commerce platform rather than layered on top of it. You configure your locations, set your fulfillment rules, and the system handles the routing. Adding a new store to your fulfillment network is a configuration task, and changing which stores offer pickup or ship-from-store doesn't require a code deployment. And when your fulfillment logic needs to go beyond out-of-the-box rules, the platform is built for code-level customization without breaking upgrades.

Because Broadleaf is built on a composable architecture using Java and Spring, you can adopt location-based inventory without ripping and replacing your existing systems. It plugs into your current stack, which means you can start using your store network for fulfillment without a months-long integration project.

The Payoff

Shipping costs drop because you're fulfilling from closer locations. Delivery gets faster for the same reason. Inventory turns improve because stock moves through whichever channel needs it instead of sitting in one place, and markdowns decrease because a slow seller at one location can fill demand somewhere else.

But the less obvious payoff is on the customer side. Shoppers who can see real availability at nearby stores, choose between pickup and shipping, and actually get their orders quickly — those shoppers come back. They're not comparing you to a competitor who offers more flexible fulfillment. They're already getting it from you.

The opening of this piece described a world where stores and warehouses operate as separate systems. For most retailers, that's still the reality. But it doesn't have to be, and the ones who close that gap are going to be hard to compete with.