The Top 5 eCommerce Trends Brands Should Prepare For in 2026

Written by

Cassandra Gaston

Published on

Dec 04, 2025

Your commerce platform is either prepared to keep up in 2026, or it's already behind. New technologies are maturing while customer expectations tighten. For many teams, 2026 will be less about experimenting on the edges and more about whether their core systems can support what the market now expects as standard.

Five shifts that matter if you want your tech stack to scale with you rather than fight you:

AI moves from experimentation to operations

Most brands spent 2023 and 2024 testing AI in small pieces: a chatbot, some content generation, maybe a recommendations engine. AI is now embedding itself into actual ecommerce workflows.

Shoppers are warming up to AI-assisted browsing. Conversational search is improving, bundling and guided selling are more accurate, and customers expect help that feels personalized. Internal teams are using AI to clear operational bottlenecks: attribution cleanup, taxonomy fixes, product tagging, merchandising rules, ticket routing, and forecasting.

Fast-moving companies treat AI as another layer of their commerce platform, not a disconnected overlay. Clean product data, stable APIs, and a platform that can absorb new services without breaking, that's what makes it possible.

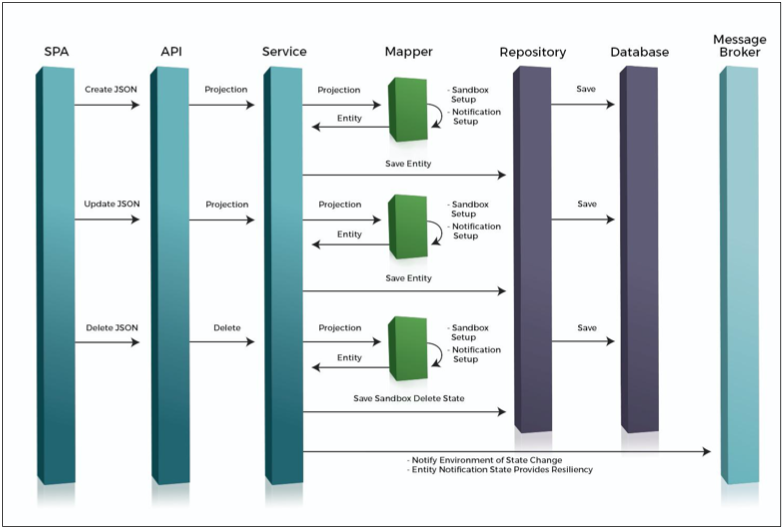

Unified commerce enables speed instead of killing it

The monolith versus headless versus composable debate has consumed a lot of energy without helping most teams ship faster. The pragmatic middle ground: keep core systems connected so you're not wasting half your roadmap reconciling data, then extend outward where unique experiences need flexibility.

Customers care that the promotion they saw online works in stores, that inventory is accurate, that loyalty benefits follow them, and that you don't show items as in stock when they're not. You only get that consistency when product, pricing, orders, customers, and inventory share the same operational source of truth.

Most brands land somewhere in between: the backbone stays connected, and specialized modules are added where they create real value.

First-party data becomes infrastructure, not just a marketing asset

Third-party data is disappearing. Regulations are tightening. Attribution is harder. The impact in 2026 reaches far beyond paid media.

Personalization, loyalty, retail media, in-store digital experiences, AI models, and demand forecasting all depend on first-party data that's organized, consented, and connected. A fractured stack makes this nearly impossible. When checkout data lives in one system, loyalty in another, product attributes in a third, and in-store transactions in a POS that never talks to anything else, personalization becomes guesswork.

Teams are treating first-party data as infrastructure now. Clean profiles, consolidated order history, and structured product data allow you to activate AI, measure retail media accurately, and tailor experiences for different customer types. Shaky foundations mean shaky everything else.

Omnichannel fulfillment is where margins are won or lost

BOPIS, curbside, same-day, ship-from-store, these used to differentiate brands. Now they're expected. The more complex question: can you do this profitably?

Store-based fulfillment gets messy without connected systems. Routing orders through the wrong location drives up labor cost, breaks SLAs, and slows inventory turnover. Many retailers still manage store fulfillment with spreadsheets, manual overrides, or rules that only the engineering team understands. Not sustainable.

The 2026 requirement: more intelligent routing, clearer operational ownership, and fulfillment logic that business teams can adjust without rewrites. Platforms with shared inventory, OMS-level intelligence, and flexible rule engines let you experiment rather than play defense.

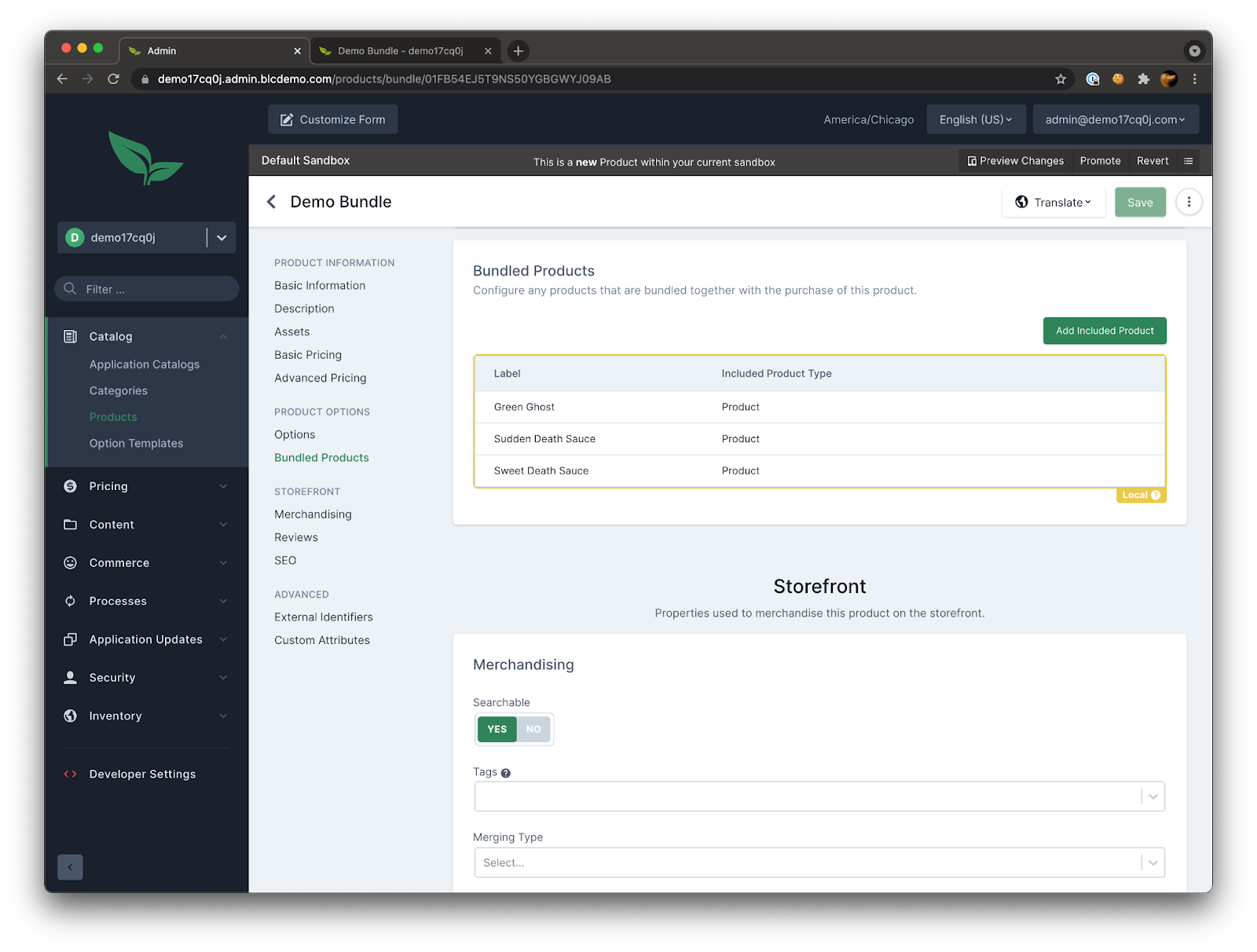

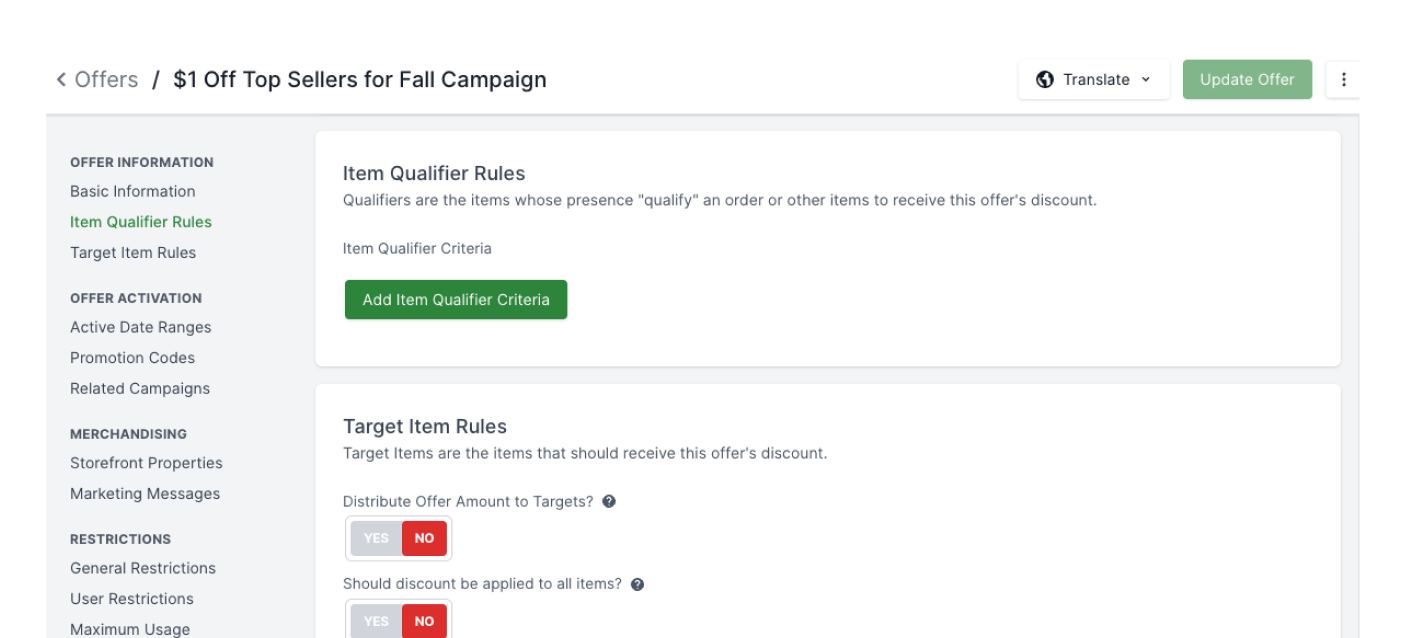

B2B capabilities matter even for brands that think they're B2C-only

Consumer retailers are adopting B2B tools because modern buying behavior demands it. Contract pricing, account-level catalogs, tiered access, quote workflows, and role-based permissions used to belong strictly to wholesale. Not anymore.

Prosumer groups, membership models, corporate gifting programs, local business accounts, nonprofit pricing, and curated industry-specific assortments all require the same mechanics. Target runs different pricing for educators. REI manages member benefits and dividend payouts. Retailers with robust gifting programs need quote workflows and bulk order management.

Running separate systems for B2C and B2B duplicates operational work and slows down launches. Platforms that support both models on a single backbone let brands evolve their sales motions without rebuilding infrastructure.

The window for catching up is closing.

You don't need to overhaul everything at once. Most companies get further by focusing on three core layers:

Stabilize the foundation. Shared data for products, pricing, orders, and customers.

Modernize the commerce core. A platform that can support multiple business models and plug into AI without constant rework.

Tune the operational levers. Smarter routing, better store workflows, and flexible fulfillment logic.

Your competitors are already moving on to these trends. The ones with better infrastructure are launching AI features in weeks, not quarters. They're testing new fulfillment models without engineering rewrites. They're activating first-party data across channels while others are still trying to connect their systems.

If your platform requires a major project just to support what's expected in 2026, you're not looking at an upgrade decision—you're looking at a replacement decision. The gap between "commerce platform as enabler" and "commerce platform as bottleneck" is widening fast.

The question isn't whether these trends matter. It's whether your current platform can handle them without breaking your roadmap for the next two years.